These Are Our Readers' Favorite Cash-Back Credit Cards

Our readers rung up a ton of nominations for the best cash-back credit card, but four options registered more recommendations than the rest of the pack, and are now vying for that coveted quick-draw slot in your wallet.

Our readers rung up a ton of nominations for the best cash-back credit card, but four options registered more recommendations than the rest of the pack, and are now vying for that coveted quick-draw slot in your wallet.

Suggested Reading

Learn more about the finalists below, see what our readers had to say, then be sure to vote at the bottom of the post!

Related Content

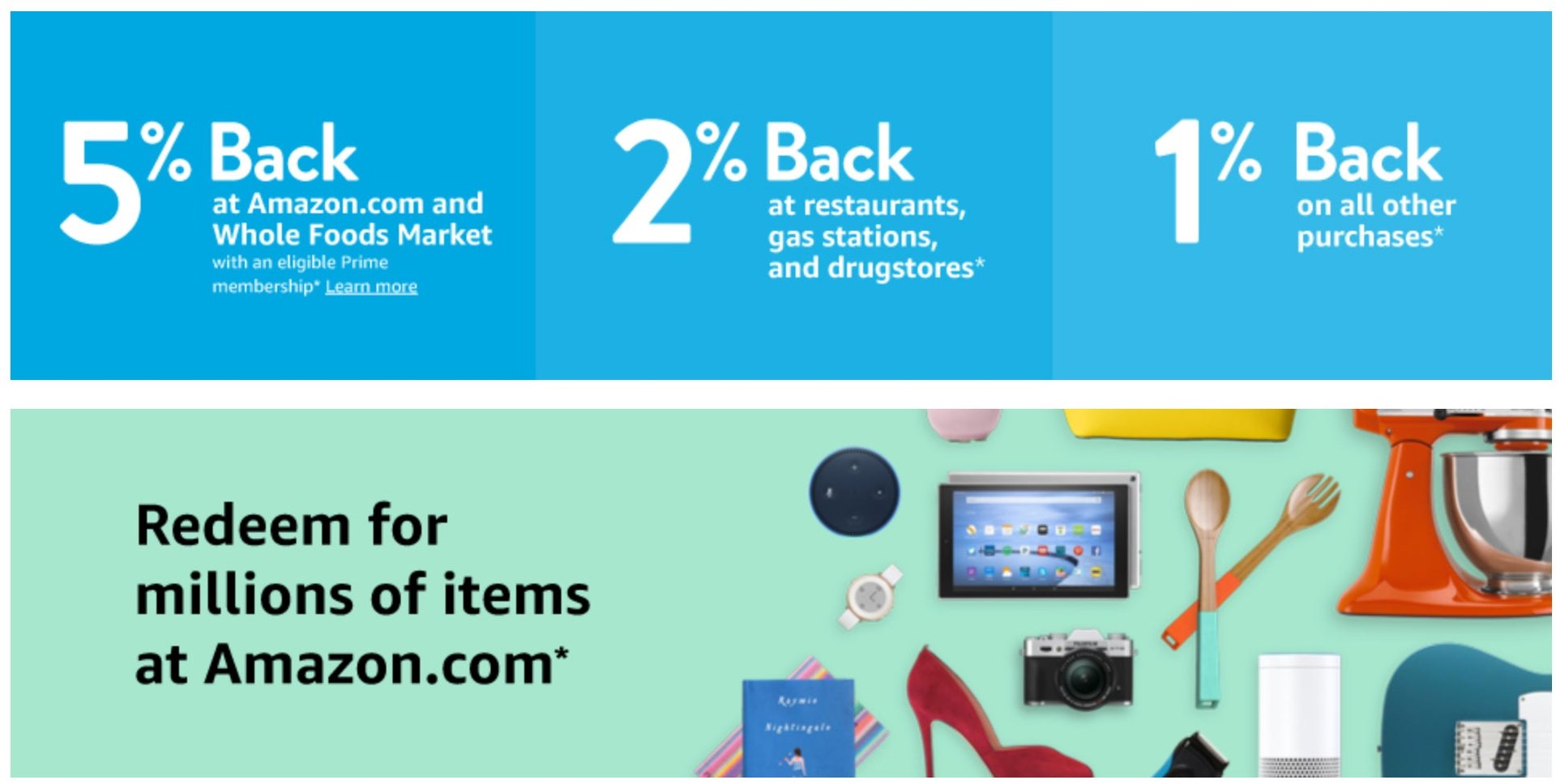

- No annual fee, but only available to Amazon Prime members

- 5% cash back on Amazon and Whole Foods purchases

- 2% cash back at restaurants, gas stations, and drugstores

I buy a ton on Amazon, so 5% back is great there. You also get 5% back at Whole Foods, for those shoppers out there. Then you get 2% back at Gas Stations and Restaurants, then 1% back at everything else. Pretty much my go to card since getting it. - yanksno1

Same. I keep my points all year and used them for Christmas shopping. Takes so much stress off at the holidays! - jenziebenzie

This is my Favorite card. I use it for everything I can. We use Amazon a lot in our household so it really pays off. Almost covered the tax in most cases and if you happen to be buying something big it really works out well. I just recently upgraded my speaker system and the $1500 I spent was a nice $75 credit.

Also, I highly recommend you just apply the monthly credit to your bill. Its a nice compounded savings that might not be massive but certainly adds up over time. - sholcomb

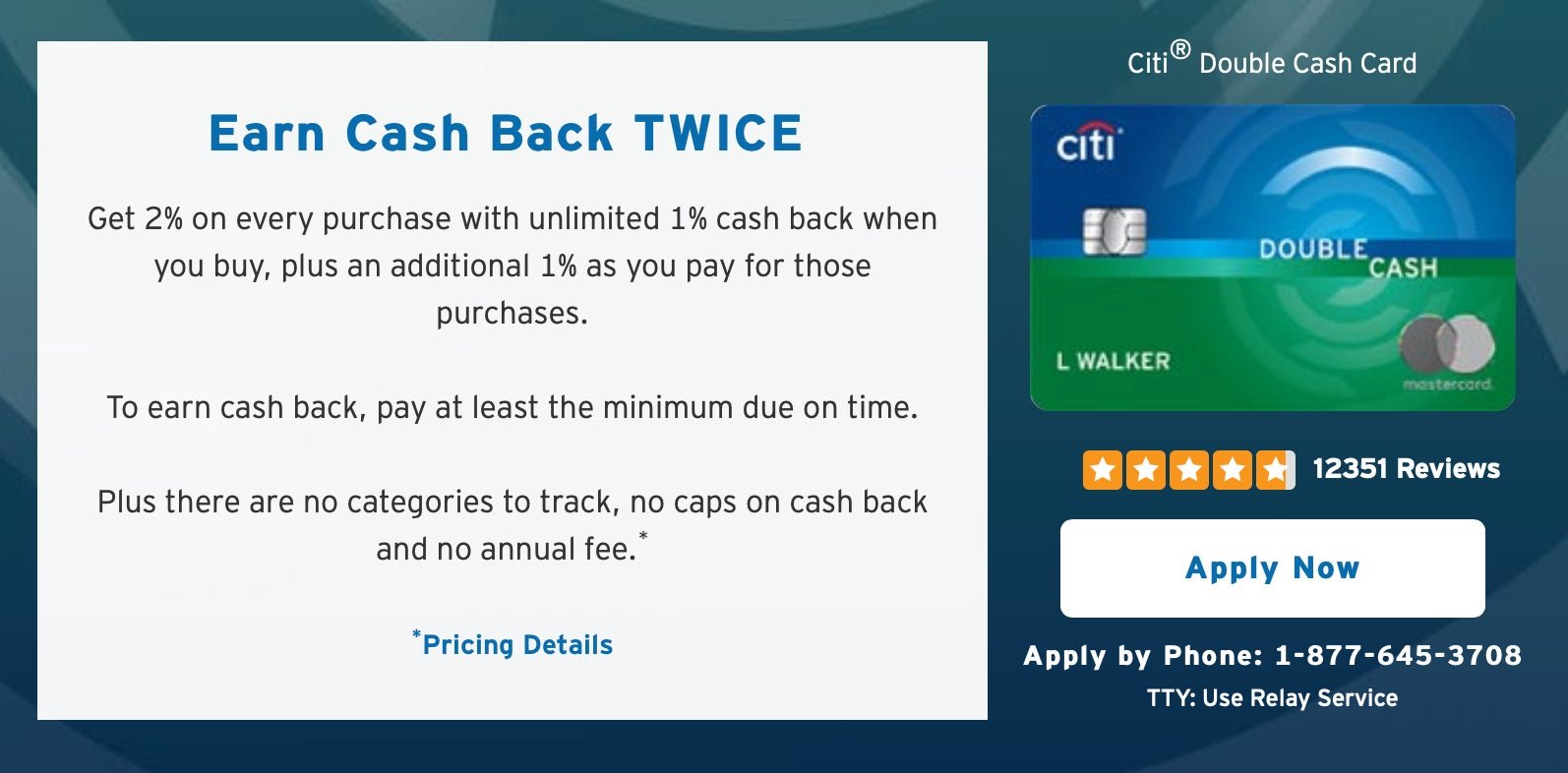

Citi® Double Cash Card

The Basics:

- No annual fee

- 2% cash back on all purchases (1% when you buy, 1% when you pay your credit card bill)

Citi Double Cash is the best general purpose cash back card for me. I pay off the bill every month and get 2% cash back. On everything. No annual fee. - discokryptonite

Citi Double Cash. It’s a no annual fee, 2% cashback card, which I love for its simplicity. - elRobRex

Blue Cash Preferred® Card from American Express

- $95 annual fee

- $250 welcome bonus after spending $1,000 in your first three months

- 6% cash back on U.S. supermarket purchases (for your first $6,000 in spend for the year, after which you’ll earn 1%)

- 6% back on select U.S. streaming services like Netflix and Hulu

- 3% back at U.S. gas stations

- 3% back on transit purchases (including Uber and Lyft)

American Express Blue Cash Preferred. 6% back at grocery stores (ed. note: U.S. supermarkets, specifically), and 3% back on gas. 1% everything else (besides a couple small things that are also 6% and 3%). There is a $95 fee but that gets made back pretty quickly. - drewsro

Fidelity Rewards Visa Signature Card

The Basics:

- No annual fee

- 2% cash back on all purchases

- Cash back can be deposited in whole or in part into Fidelity investment accounts

2% cash back on all purchases, cash back deposited monthly into Fidelity account.

No annual fee

I like it because it is simple, no silly rules, no registering to get extra cash back, etc. - jeffffd

Not to mention at the end of the day it will be worth a lot more than 2% if used wisely. For me, I put all my rewards in my daughter’s 529 plan. I figure over the next 14 years that will appreciate rather well and is a simple way to save a little more with no effort. - Moose Knuckle

G/O Media Commerce has partnered with The Points Guy Affiliate Network for our coverage of credit products. Gizmodo Media Group and The Points Guy may receive a commission from card issuers.